Fido Micro Credit 3.3.1.8

Free Version

Publisher Description

In need of micro-loans to grow your business or pay fees?

Join millions of satisfied Fido customers and get access to fast loans right into your mobile money wallet.

Licensed by the Bank of Ghana.

------------------------------------------------------------------------------

Why get a Fido loan?

👍 Apply on your phone; anytime, anywhere.

👍 Receive a loan request decision within minutes.

👍 No hidden fees, all costs are displayed in the app.

👍 No paperwork, No waiting in bank queues.

👍 No collateral & No guarantor.

👍 Money is disbursed instantly.

What do you get with Fido?

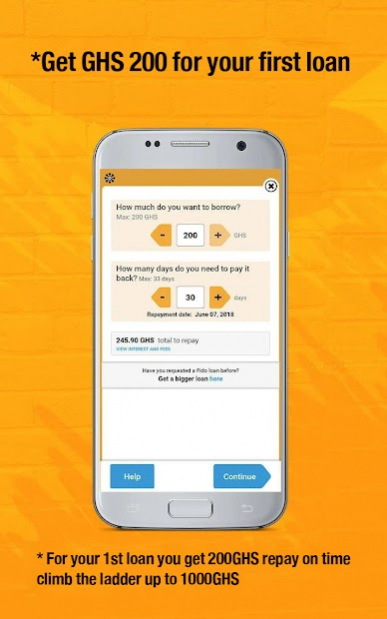

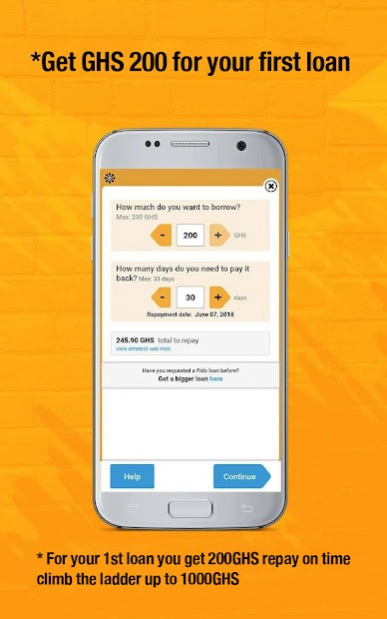

✓ Receive up to GHS200 for your first loan and repay between 10 and 33 days

✓ Your loan amount is increased every time you repay on time, up to a maximum of GHS1,000 with a maximum of 3 months repayment period

✓ As the loan increases, we decrease the interest rate and offer installment options

✓ Interest rate and total amount to repay are displayed in the app

What do you need to apply?

✓ A valid ID (Voter’s ID, NHIS card, Driver’s license & Passport)

✓ A mobile money account registered in your own name

✓ We accept MTN, AirtelTigo & Vodafone mobile money wallets

✓ Be a resident of Ghana, over 18 years of age

How to Apply?

✓ Download the app and fill in your details only once. For subsequent applications, you only need to confirm your details

✓ Receive an immediate loan decision

✓ If approved, you will receive the money instantly into your mobile money account

How to repay?

✓ If you owe, log into the FIDO app, select the 'Make a Payment' button and follow prompts.

✓ For other options like using the MTN, AirtelTigo payment menu, find the repayment process in the mobile app help section.

✓ Repay on time and be eligible to take another loan.

Dos and Don’ts- Fido Loan Application

Don’ts

✓Don’t use a mobile money number that does not belong to you.

✓Don’t use someone’s ID card.

✓Don’t use names that are not on the ID card or shorten it (Ex. Do not write Abiba❌ if the name on your ID is Abibatu✔)

✓Don’t use an ID card that has spelling mistakes or the wrong date of birth. Contact your service provider to correct the error before applying again.

✓Don’t apply for someone else.

Dos

✓Ensure that you type your correct ID number

✓Ensure that you type the mobile money number correctly

✓Ensure that the date of birth you select is correct, and it’s the same as the date of birth on the ID

✓Ensure that there are no mistakes with the name and date of birth on the ID card you want to use for the application

✓Ensure to repay your loan on time to continue doing business with Fido

------------------------------------------------------------------------------------

Fido Micro Credit (Fido) is a licensed financial institution by the Bank of Ghana, providing credit to eligible borrowers, especially SMEs in Ghana.

Flexible repayment terms are chosen by the applicant. The terms vary between 10 and 90 days, payable in one or multiple installments, depending on eligibility. The loans are intended to assist micro-entrepreneurs with working capital to grow their businesses, and not to service long-term debt obligations.

Maximum Annual Percentage Rate (APR) is 71%. This is based on an interest set to 0.266% per day and decreases with good repayment behavior. The fee per loan is GHS 14.

Representative Example:

A borrower may take up to GHS1,000 to be repaid in 3 monthly installments, with declining principal, at a rate of 0.266% interest per day.

The representative Annual Percentage Rate (APR) for such loan, including all interest and fee costs, is 71%. However, this rate is for reference only. Fido loans are not repaid annually and do not compound interest and are not eligible for extension or refinancing beyond the stated term.

------------------------------------------------------------------------------------

Contact us on 0242436885 or www.fidocredit.com for more details

You can be assured of data privacy with Fido

About Fido Micro Credit

Fido Micro Credit is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Fido Micro Credit is Fido Solutions. The latest version released by its developer is 3.3.1.8. This app was rated by 3 users of our site and has an average rating of 3.7.

To install Fido Micro Credit on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2021-09-06 and was downloaded 346 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Fido Micro Credit as malware as malware if the download link to com.fidocredit is broken.

How to install Fido Micro Credit on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Fido Micro Credit is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Fido Micro Credit will be shown. Click on Accept to continue the process.

- Fido Micro Credit will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.